StokBox

UX & UI Project

StokBox is rethinking the consumer food supply chain to address the plastic problem and significantly reduce single-use plastics, and other food packaging waste, going to landfill.

Their goal is to partner with worldwide leading food brands, to bring an end to packaging waste in the supply of consumer food products. They offer a solution through the development of a digital dispensing platform at point of purchase, coupled with smart, reusable packaging.

Distilled Project Challenge

This noble and necessary undertaking will only succeed if brands and retailers see the demand from mainstream shoppers, who will need to modify how they buy their food. So, how do we change shoppers’ deeply ingrained behaviours?

Understand underlying preferences, motivations and frustrations

Discover how much disruption/friction shoppers are willing to tolerate

Identify what would incentivise behaviour change

My Role

Member of a UX/UI design team of three for the discover and define stages for the project. The develop and delivery stages were tackled individually.

The Research

Getting Started

We took some time to work through the lengthy brief before our first stakeholder interview with StokBox’s Founder. While talking with him, we discovered he has extensive knowledge of the landscape and of technology, and was happy to share with us.

The Founder helped clarify the project challenge, introduced us to the product adoption curve, and requested we focus on the behaviours of early and late majority mainstream shoppers.

Product Adoption Curve. From Crossing the Chasm by Geoffrey A. Moore

He also explained that the StokBox tech is still being developed and will be informed by insights gained through our research.

Understanding The Landscape

We then moved on to understanding the landscape in which StokBox will exist and the competitors within the space. There was a lot of ground to cover, largely unknown to us. It was eye-opening just how businesses, charities and NGOs are involved in recycling, reusing and researching. We only scratched the surface.

Many scary statistics confirm that single-use plastics and excessive consumer goods packaging are the most visible symptom of the harm we are inflicting on the environment, spoiling the landscape and negatively impacting human and animal health.

20–500

The number of years it takes for plastic to decompose

44%

The official England ‘waste from households’ recycling rate for 2020/21

9%

The amount of all plastic ever made, that has been recycled

The fact all the plastic produced, which has ended up in the environment, is still there in one form or another, really inculcates the need for a solution.

Even with more people recycling, the world’s population will keep growing. More people using a smaller percentage of plastic still equates to more plastic than we can deal with.

A typical refillable bottle only has to be used 15 times to have a lower carbon impact than a single-use plastic bottle!

It, therefore, stands to reason that…

…reusing is an even better proposition than recycling.

Competitor Analysis

We looked at existing reusable packaging and systems to discover some of the current direct and indirect competitors and what they offer.

Collectively, we also visited specialist shops, like Planet Organic, dedicated zero waste shops, like The Source Bulk Foods, and pilot schemes in supermarkets like Tesco and Asda. We looked at how the refill stations are presented to shoppers, how to access the products and the pain points of shopping this way.

User Research: Screener Survey

We distributed a survey to get some quantitative data. The aim was to help us understand decision-making during food shopping. We had 173 responses.

Interestingly, our responses correspond to Statista’s findings from their survey of 5,548 respondents.

82.7%

surveyed do the majority of their household food shopping in supermarkets

83.8%

surveyed go household food shopping at least once a week

76.9%

take their own shopping carrier bags all or most of the time

The Main Reasons Behind Choosing A Supermarket

Importance Of The Amount Of Packaging, And Its Recyclability, On Product Selection

Rated 1 (not at all important) to 10 (very important)

Y-axis = the number of responses. X-axis = level of importance

User Research: User Interviews

We used the responses from the screener survey to identify a pool of interviewees. We interviewed shoppers visiting physical supermarkets, who shop at least once a week, and either walk or drive, to get there.

We wanted to understand how they go about food shopping and why they feel the way they do about it. We also wanted to gauge their interest in, and understanding of, zero waste, recycling and reusing to get an idea of what it would take to buy into reusable packaging and what would motivate them to make a change.

A total of 32 interviews were conducted, resulting in over 1,000 data points. We went through all the data, assigning each point to a post-it, and then grouped the post-its into themes and trends.

Affinity mapping

Key Insights About Shopping

From our user research we learned the following about behaviours and preferences surrounding food shopping:

Price is key – must be the equivalent price to a regular shop or cheaper

Shopping is a necessity, not an experience – must remain convenient so shoppers can get in and out quickly. No one likes a queue

Everyone loves a discount and incentive – shoppers can be incentivised by discounts and loyalty schemes

Too much packaging – brands and supermarkets need to reduce their output

Current app usage is low – hands are needed for collecting and transporting shopping. Shoppers don’t want tech distracting them or slowing them down

“I just want the shopping experience to be quicker. I am not there to have fun.”

“I love a bit of money off.”

"I've got one hand holding a basket and another hand taking items off the shelf. Using an app at the same time wouldn't really work."

Key Insights About Recycling

Through our user research we also gained further understanding of our respondents’ knowledge and perception of recycling:

Education is needed around what is and isn’t recyclable and how to recycle

There is a lack of clarity and transparency on recycling disposal

Shoppers have mixed feelings regarding the government’s motivations behind their initiatives. Are initiatives to promote change or make money?

Shoppers want the government and brands to take more responsibility

“Things need to be a lot simpler. My mum calls me almost everyday to ask about how and what to recycle.”

"There isn't enough clarity around what is recyclable and what isn't and how to recycle. I think most of what we try to recycle goes into landfill, to be honest. The chance that it won't land up in landfill is what keeps me recycling."

Most Importantly

Shoppers are open to change, as long as the change adds value and only requires tweaks to current behaviour, not altering it entirely.

“I would try the refill station if it's accessible in my local supermarkets."

“I would love to be less wasteful if it makes sense and is convenient.”

And…

Shoppers allude to being receptive to having more personal accountability. They note that, no matter their intention or motivation, they have no control over what gets recycled or if items get recycled at all.

By highlighting the role refilling reusable packaging can play in addressing the waste and excessive packaging problem, shoppers can be empowered to make choices and take actions to be part of the solution. They will be able to take some of the power back.

“I would reuse everything I possibly could, but there aren't many things that you can.”

“Recycling is out of my hands. I put things in a recycling bin but I don't see it get recycled or go off to the right place.”

Issues And Challenges

StokBox will need to keep the following in mind when creating a solution:

Refill stations are perceived as being more expensive/and or exclusive

Current refill station shoppers are self-motivated. Those who don’t use them don’t know where they are or how they work

Deposits can be expensive. Not everyone will have the initial outlay

People use cars, public transport and walk so carrying packaging can be cumbersome

Designing A Solution

Discovering StokBox

To understand the user journey, I focused on an archetype, based on a substantial number of our interviewees’ demographics and responses.

The Archetype = Busy, urban professionals, in their 20s, 30s and 40s, who are increasingly environmentally-conscious shoppers

So, how would these shoppers learn about StokBox? Where would they encounter StokBox? What information do they need to understand and use it? How does it work? I spent a lot of time thinking about all the touchpoints and what the StokBox experience would be.

Storyboard – before, during and after using StokBox

Areas to address: information needed by the user (orange), encountering StokBox (pink), using the app (yellow), collecting the product (green)

Tech Assumptions

As the technology is still being developed, I made the following assumptions about how StokBox works:

The app is integral to using StokBox dispensers

StokBox uses its own foldable, product-specific smart packaging

Key information is displayed to the shopper via the dispensers

Ideation

Discover StokBox via Sainsbury’s website

Discover StokBox via Sainsbury’s app

StokBox website

StokBox app

Going Digital

StokBox app

View the prototype to see the following:

Onboarding

Joining StokBox / Signing in

Scrolling through the home screen

Viewing ‘Rewards & Referrals’ from the home screen

Viewing personal QR code

Viewing in-store information guide

Starting a new shop

Viewing available products

Picking up a saved shop

Buying 500g of Kellogg’s Corn Flakes

Viewing the current packaging

Returning the current packaging

Adding Hendon location to favourites

Viewing favourites

Viewing account

Above-the-line view of the StokBox homepage

All the educational and informational content on the app and more would be available on the website.

Site visitors are encouraged to download the app by the prominent placement of the ‘GET THE APP’ button.

‘Customer Sign In’ allows for account management and personalising the relationship with StokBox.

‘StokBox Business’ is a separate section specifically for brand and retail partnerships which would address everything not relevant to shoppers.

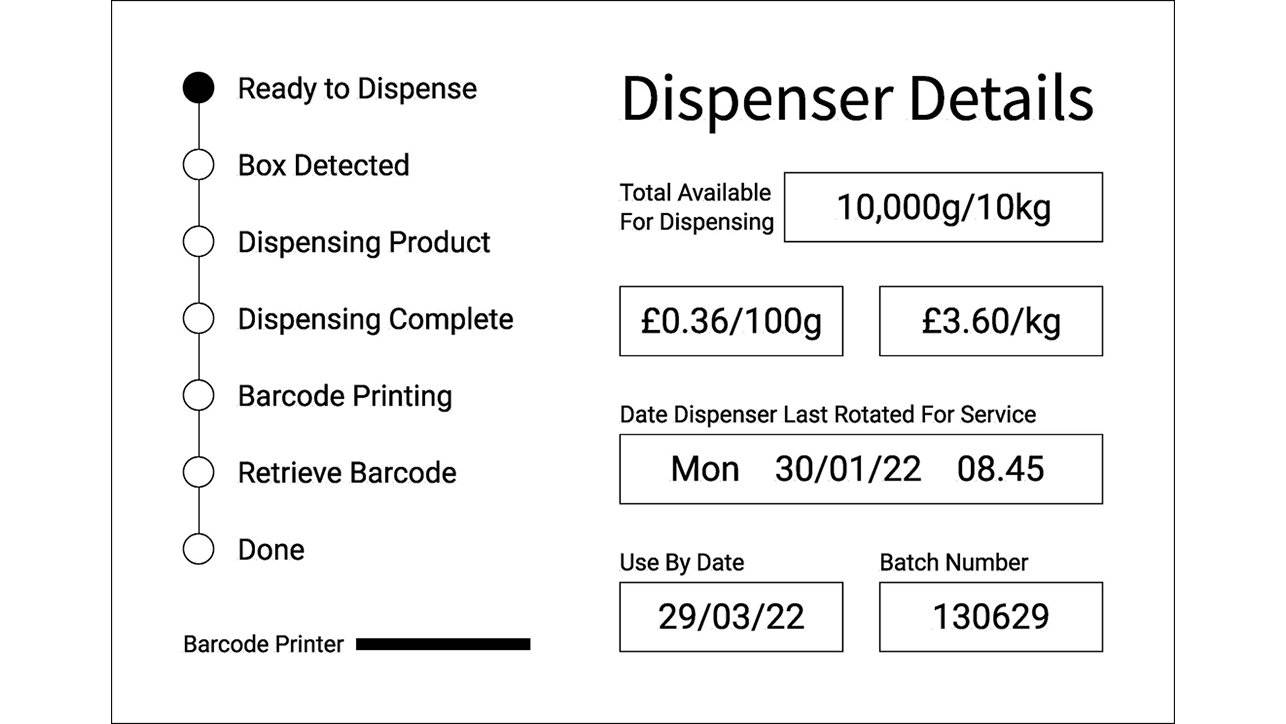

Details displayed on the in-store StokBox dispenser

The tracker on the left informs the shopper as to where they are in the dispensing process and ensures the necessary steps are followed.

The final step is printing the barcode, which is dispensed below the tracker.

Product and dispenser information would be displayed on each unit to address issues of price transparency and concerns about product freshness and dispenser cleanliness.

Due to time constraints, I was not able to increase the fidelity of my designs or do as much testing as I would have liked.

StokBox Next Steps

Investigate where best to pilot and who to target

Work on visibility through marketing and partnerships

Develop and/or source educational resources

My Next Steps

Further exploration, through the Experience Haus Product Strategy and Management course, to understand StokBox from a business perspective and how it can position itself in the marketplace

Increase wireframes fidelity and more testing

Client Feedback

The client was very impressed with the quantity, breadth and quality of work we were able to deliver. Our design solutions differed slightly and the client felt spoilt for choice, noting that there were elements of all our work he would like to incorporate into his product.

“Look out for the fruits of your labour in the product going forward.”

Additional Lessons Learned

When interviewing, allow interviewees to share their experiences and insights without direction. Don’t be prescriptive with the questions. Remember the aim is to uncover the underlying preferences, frustrations, motivation and behaviours by asking ‘Why?’.

Trust the process. Work through the steps and use the research to inform a solution. Then…

Test, test, test. Get a version out as quickly as possible. Test it and be prepared to review and rework it and then test some more.

Know that everything takes practice.